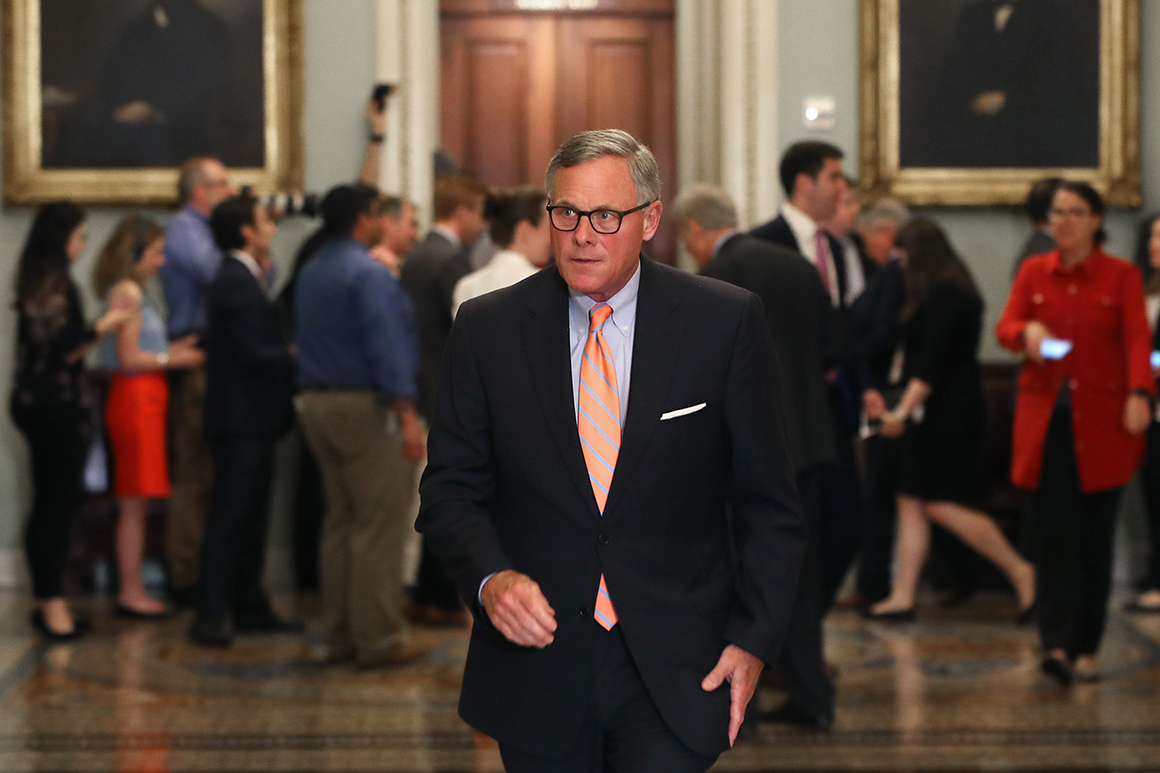

Burr, who is retiring at the end of 2022, has faced calls to resign from across the ideological spectrum since ProPublica reported Thursday that he dumped between $628,000 and $1.72 million of his holdings on Feb. 13 in 33 different transactions — a week before the stock market began plummeting amid fears of the coronavirus spreading in the U.S.

The North Carolina Republican has also come under fire for a secret recording obtained by NPR from Feb. 27, in which he issued a much more dire warning to a group of attendees at a private luncheon about the potential outbreak than the prognosis he was offering publicly at the time.

Both liberal Rep. Alexandria Ocasio-Cortez (D-N.Y.) and conservative Fox News host Tucker Carlson have called on Burr to step down. Carlson said „there is no greater moral crime than betraying your country in a time of crisis“ and said Burr should resign and face prosecution for insider trading, if the report is true. Ocasio-Cortez, meanwhile, said it was „stomach-churning“ that someone would think to „profit off this crisis.“

Sen. Thom Tillis (R-N.C.), who is up for reelection this year in the Tar Heel state, didn’t go so far as to ask for Burr’s resignation, but did say Burr owes an explanation — and the pending Ethics probe now gives Tillis, and others, some cover to call for the investigation to play out.

“Given the circumstances, Senator Burr owes North Carolinians an explanation. His self-referral to the Ethics Committee for their review is appropriate, there needs to be a professional and bipartisan inquiry into this matter, which the Ethics Committee can provide,” Tillis tweeted.

The Ethics Committee, which is chaired by Sen. James Lankford (R-Okla.), is made up of three Republicans and three Democrats. The panel is notoriously slow and rarely takes punitive action against its peers, but with the Capitol focused on battling coronavirus — and some members limiting their interactions or being forced to go on self-quarantine — the probe could move at even more of a snail’s pace.

„Such a low-energy establishment Senate response,“ tweeted Rep. Matt Gaetz (R-Fla.), a firebrand conservative. „‘Self-referral’ to ‘Senate Ethics’ is the safe space where Senators can judge their own w/o real culpability. You, Senator Tillis, referring Burr to the DOJ for prosecution would evidence a sincere concern for North Carolinians.“

Burr infuriated Trump’s conservative allies last year when he subpoenaed Donald Trump Jr., though they ended up working out the terms for an interview with his panel.

Burr has acknowledged making at least one financial decision based on what he’s heard from federal officials: he said in 2009 that he encouraged his wife to withdraw cash from the ATM after hearing from Treasury Secretary Hank Paulson amid the 2008 financial crisis.

If Burr traded stocks based on information that was not available to the public, it could not only be an ethics issue, but a criminal matter as well. The 2012 STOCK Act prohibits members of Congress from insider trading.

Former Rep. Chris Collins (R-N.Y.) was sentenced to 26 months in prison for his role in an insider trading case. Collins was a major investor in Innate Immunotherapeutics and even pitched the stock to fellow members. But Collins allegedly told his son about the firm’s failed drug trial months before it was public, allowing his family members to dump their shares before the stock collapsed.

Burr’s committee was receiving regular classified briefings on coronavirus at the time of the stock sales, according to Reuters, but Burr has insisted that he used public reports to make investment decisions.

In an initial statement, a spokesperson for Burr confirmed the transactions but noted they took place before the market volatility.

“Senator Burr filed a financial disclosure form for personal transactions made several weeks before the U.S. and financial markets showed signs of volatility due to the growing coronavirus outbreak,“ his spokesperson said. „As the situation continues to evolve daily, he has been deeply concerned by the steep and sudden toll this pandemic is taking on our economy.“

Burr also punched back at the NPR report on Twitter Thursday, calling it a „tabloid-style hit piece“ and noting it was a publicized event that included „many non-members, bipartisan congressional staff, and representatives from the governor’s office.“

Burr is not the only one under scrutiny for their recent trading practices: Sen. Kelly Loeffler (R-Ga.) sold off more than $1 million in stocks in the days and weeks following a private coronavirus meeting — then bought shares in a company that offers teleworking software, according to the Daily Beast.

Loeffler, who is on the ballot this fall, was a wealthy business executive before being appointed to Congress late last year and is married to the chairman of the New York Stock Exchange.

“This is a ridiculous and baseless attack,” Loeffler wrote on Twitter. “I do not make investment decisions for my portfolio. Investment decisions are made by multiple third-party advisors without my or my husband’s knowledge or involvement.”

In an interview with CNBC, Loeffler declined to call for an Ethics probe into herself but said she would „submit to whatever review is needed.“

Sens. Jim Inhofe (R-Okla.) and Dianne Feinstein (D-Calif.) also sold significant stocks from their portfolios over the last several weeks, according to the New York Times, but Inhofe told reporters Friday that he did not attend a Jan. 24 briefing on the coronavirus.

„The answer is no, everybody knows I didn’t do that,“ Inhofe said, when asked whether he made the sales to prevent coronavirus-related losses. „I didn’t even attend the meeting.“

Inhofe, who chairs the Senate Armed Services Committee, added that he would cooperate with an Ethics investigation but said it’s up to his colleagues to decide whether to open one.

Common Cause, a Washington-based watchdog group, filed complaints against all four lawmakers — Burr, Loeffler, Inhofe and Feinstein — with the Department of Justice, the Securities and Exchange Commission and the Senate Ethics Committee, citing the STOCK Act.

“These potential violations of insider trading laws and the STOCK Act by these Senators … show what appears to be contempt for the law and further a contempt for the American people these Senators have sworn to serve,“ Karen Hobert Flynn, president of Common Cause, said in a statement.

John Bresnahan and Marianne LeVine contributed to this report.

Source: politico.com

See more here: news365.stream