Advocates for the commercial space industry have asked Congress to act to help struggling companies, including establishing a grant or loan program, designating the space manufacturing workforce as essential and accelerating tax credits that could provide quick access to cash.

But money spent on big national efforts will benefit more parts of the space industry than propping up one sector, Beck says. He insists the stimulus that would come with a new program would trickle down — from employees who design and build spacecraft to launch companies who need to get the spacecraft into orbit.

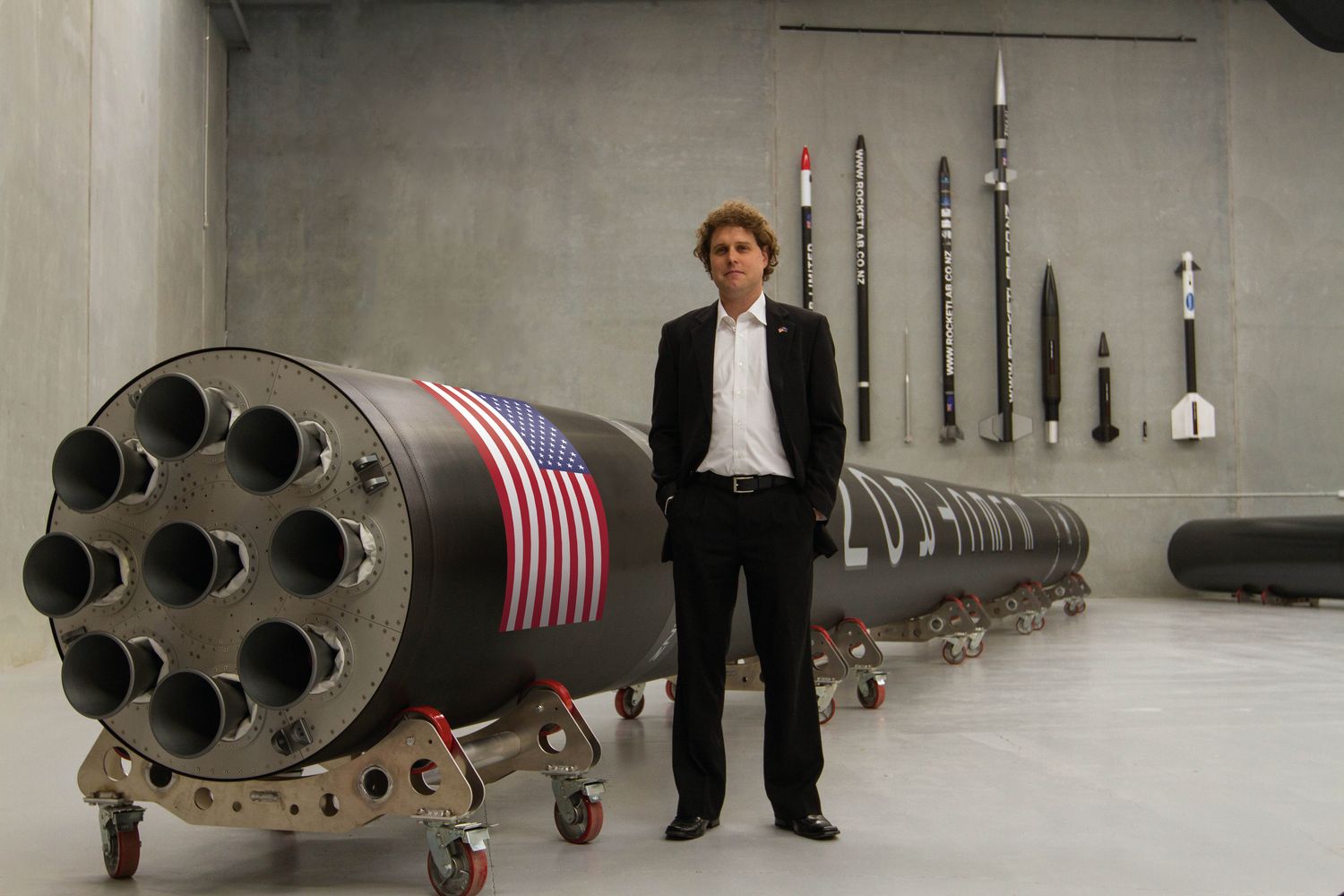

“Spacecraft require launch, so it keeps launch healthy. If you only support one sector [like small launch], you might have three or four small launch companies, but there’s nothing for them to launch. Ultimately, that’s not sustainable,” said Beck, a New Zealand native who founded Rocket Lab in 2006 to make small satellite launch services available to a broader community at a cheaper price.

Beck also outlined which new space communities he predicts will see the greatest impact from the economic crisis and how his own company is weathering the pandemic.

He noted Rocket Lab recently completed a new round of fundraising to prepare the company, which has launch sites in New Zealand and the U.S., for another emergency.

“That round was to weather any nuclear winter,” he said. “To be fair, global pandemic was not on my list of things that could have occurred. I was more thinking of blowing a rocket up on the launch pad.”

This transcript has been edited for length and clarity.

What are you seeing in the new space industry during the pandemic?

The new space industry has enjoyed a long, warm summer. I can recall when I first raised our capital, I was the crazy guy walking around Silicon Valley trying to raise money for a rocket company $5 million at a time. The peak for small launch would have been the last half of last year, where we saw $140 million rounds.

But now, venture capital is gone. VCs have receded onto the shelves. Even if a vaccine was created tomorrow and the world magically world returned to normal, it will still take a while for the VC community to continue to get back to the point where it was. … The general consensus is that in six months time we’ll see some capital flow into companies that are well-healed and have revenue. … Six months after that, we’ll see some capital flow into companies that have early revenue. Then six months after that, capital will flow into prerevenue companies.

If you’re a start up and you don’t have a year to a year and a half of runway or you don’t have a business actually generating good revenue, it’s a very difficult time. … There’s going to be a lot of potential failure in the industry. I personally don’t want to see really wonderful teams get laid to waste, so I think it’s natural that some consolidation will happen, but the challenge with consolidation is because the industry has enjoyed such a long summer, the valuation [of companies] is sitting at levels that would be hard to justify. … None of this is good for the new space industry.

Are there any communities that are particularly at risk?

It’s all venture-backed new space companies, but it’s fair to say small launch companies will weather the brunt. … There are 140 small launch companies, according to some reports. The last couple of years, it seems like there’s a new one every week. … It’s hugely capital intensive. It’s a quarter of a billion dollars to put a vehicle on the pad and successfully get to orbit. That’s generally the rule of thumb. That’s just to get to orbit. You have to spend that again to get into full production and actually deliver vehicle after vehicle.

Ultimately, launch is at the bottom of the chain. If satellite companies are failing, then there’s nothing to launch. So I think small launch is going to see the most amount of disruption.

How is Rocket Lab doing?

We’re fortunate to be in a position where we have a product and we have strong revenues. We completed a $140 million fundraising round a year and a half ago. … That round was to weather any nuclear winter. To be fair, global pandemic was not on my list of things that could have occurred. I was more thinking of blowing a rocket up on the launch pad.

What can the government do to support these new space companies?

I think this is very dangerous. … If you take somebody else’s job and you displace that person’s job, they no longer have a reason to exist. So if the government fills the role of venture capitalist, that’s very unhealthy because that market is critical to innovation and to growing companies. You don’t want to take over the role of VCs. My view here is very simple: the government needs to inject itself at the highest point of the supply chain.

So, for example, don’t invest in small rocket companies, invest in programs. Because when you invest in programs, you build spacecraft, which keeps the spacecraft industry healthy. Spacecraft require launch, so it keeps launch healthy. If you only support one sector [like small launch], you might have three or four small launch companies, but there’s nothing for them to launch. Ultimately, that’s not sustainable.

If you put up a massive constellation of weather satellites with the latest sensors … you’ve stimulated the industry and you have the ability to monitor climate and climate change at a rate and precision you never had before. It’s a massive win in many fronts.

What impact will this have on national security?

One side of it is if there aren’t those demand signals and that support, then an entrepreneur will look to fund their company anyway possible. You risk losing teams and you risk losing technologies to other countries. That’s a reality. For some actors, this is like picking a field of strawberries. We have to be really careful that those technologies, those people, and those teams are retained, but this is where it takes true courage because you won’t be able to save everything. You really have to be bold on which things really are in the national security interest of the country and which things really aren’t.

What does the new space industry look like when this downturn is over?

I think you’re going to lose the companies that are very forward looking. Things like asteroid mining and interplanetary colonization and all those things that are a bit more speculative, they’re going to go away, which is a great shame because those are the things that are likely to fail anyways but they would still push technology and push thinking much further forward.

Source: politico.com

See more here: news365.stream