The former New York City mayor also wants to raise taxes on capital gains, hike the corporate tax rate, stiffen the estate tax and repeal a new break for „pass-through“ businesses, whose owners pay individual rather than corporate taxes on their earnings.

The proposals do not go as far as some of the other candidates’ plans.

Bloomberg is eschewing, for example, the idea of a wealth tax embraced by Elizabeth Warren and Bernie Sanders, which would dun an array of assets besides income, like artwork and second homes. And he wouldn’t be as zealous as some in raising corporate taxes.

But the proposal puts Bloomberg squarely in the mainstream of the Democratic primary this year, where calls for trillion-dollar tax increases on the well-to-do — coupled with trillion-dollar spending plans — have become the norm.

Bloomberg wants to use the money raised to finance plans to expand health benefits, improve the nation’s infrastructure, boost affordable housing and invest in clean energy projects, among other initiatives.

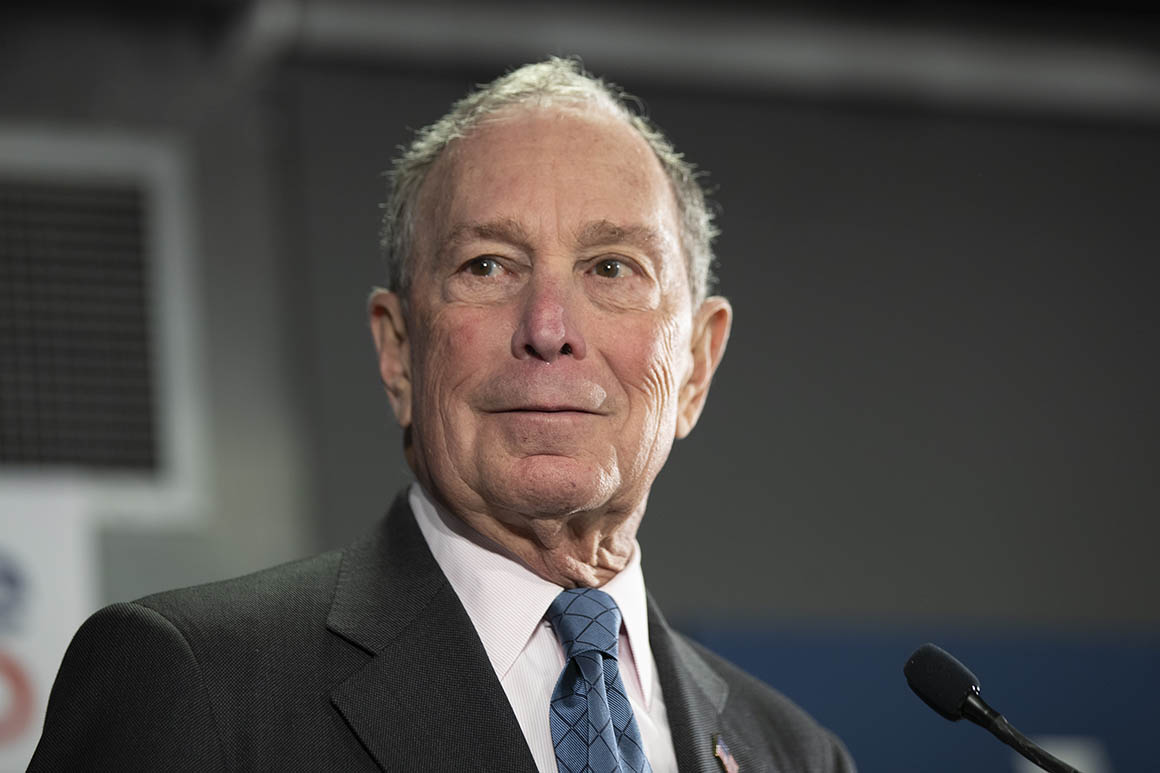

“Those investments require new revenue – and a fairer, more progressive tax system that asks wealthy Americans like me to pay more,” Bloomberg said in a statement. “The plan I am releasing today raises rates on wealthy individuals and corporations, closes loopholes, cracks down on tax avoidance, expands the estate tax, and reduces the tax advantages that investors have over workers.”

Many of the ideas would amount to at least partially reversing Republicans’ 2017 tax overhaul.

Bloomberg would push the top income tax rate back up to 39.6 percent, where it was before Republicans cut it to 37 percent, while toughening the estate tax.

On businesses, he would push the corporate rate up to 28 percent, from the current 21 percent — stopping short of fully raising it back to the 35 percent rate that prevailed during the Obama administration and before. He would tighten the tax law’s new minimum tax on multinational corporations’ foreign earnings, and end a new 20 percent deduction for pass-through businesses.

Many of the other proposals go beyond the Tax Cuts and Jobs Act.

Bloomberg wants to dump special preferential rates on capital gains for people earning more than $1 million, and instead tax those gains, from things like stock sales, as ordinary income. He also wants to make it harder to avoid or defer those taxes.

The plan would also prevent the rich, when they die, from passing assets on to spouses and children tax-free by ending a decades-old break known among experts as “stepped up basis at death,” which provides a deep discount on the value of inherited wealth. Instead, Bloomberg would tax those assets when the person died.

He is targeting smaller breaks as well, including the much-criticized “carried interest” provision that benefits investment managers and so-called “like-kind” exchanges that allow real estate developers to defer taxes.

Bloomberg’s campaign called the tax plan a work in progress. Many of the proposals, such as his plans for the estate tax, lack specifics.

That’s because he is committing to paying for all of his spending initiatives, his campaign said, some of which have yet to be rolled out.

Depending on how much money he needs, Bloomberg could tighten up the proposals or add new ones.

“We haven’t finished rolling out the policy plans so we don’t know what the full cost will be, so there will be more details in this plan eventually,” a spokesperson said.

Bloomberg decided against backing a wealth tax, aides said, in part because of practical concerns, including the possibility that it could be blocked by courts.

Many law experts say a tax on wealth would run afoul of a slavery-era provision in the Constitution requiring “direct taxes” to be divvied up among the states, according to their populations.

“There is a practical and achievable nature to this tax plan,” a Bloomberg spokesperson said. “He feels this plan is realistic.”

Source: politico.com

See more here: news365.stream