Scott Sloofman, a top communications aide in Senate Majority Leader Mitch McConnell’s office, purchased stock in a company that could wind up being instrumental in the fight against the coronavirus in late January: Moderna, Inc., which is now testing the first vaccine for the disease in Washington state.

Sloofman purchased the stock on Jan. 28, one week after Moderna, Inc. announced it was collaborating with the federal government to develop the vaccine. The company’s stock rose in the days since, at some points more than 20 percent.

The purchase was listed as between $1,001 and $15,000 in value. A Senate aide familiar with the trade said Sloofman purchased just under $1,400 in stock. He bought the stock two weeks after seeing a CNBC segment featuring Moderna’s CEO discussing plans to develop new medications on Jan. 15, the aide said, and Sloofman does not focus on health care or national security policymaking for his job.

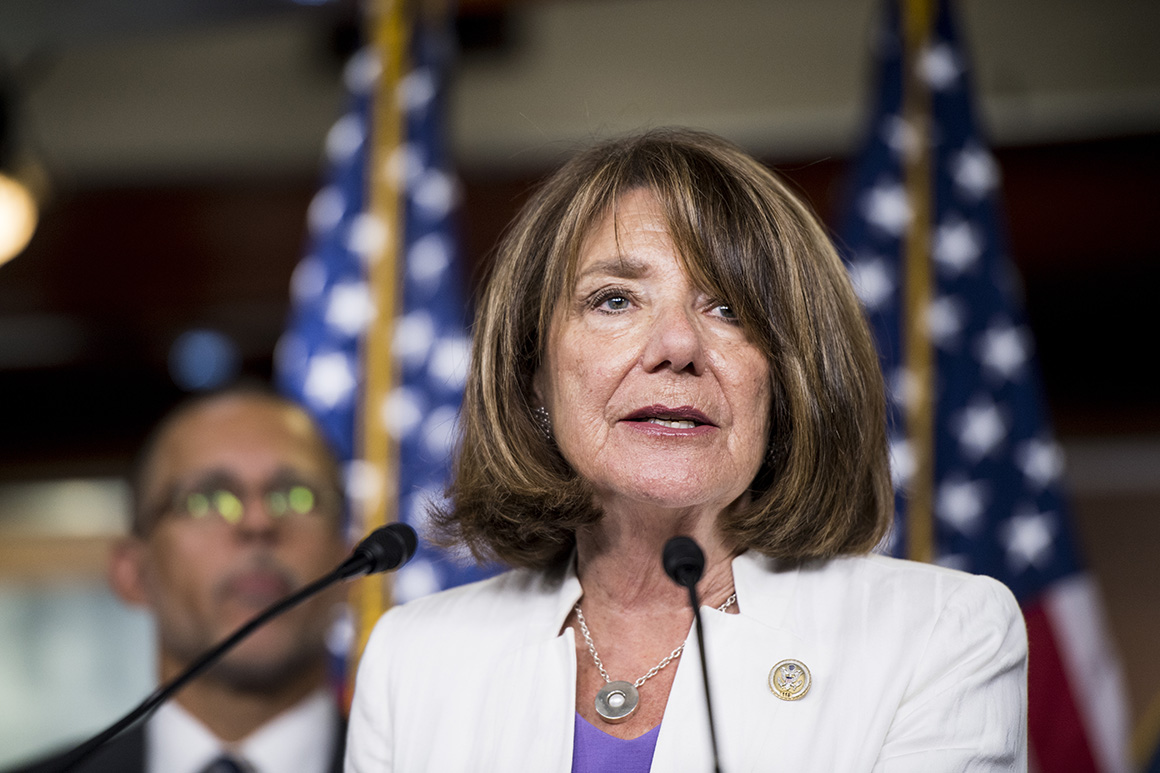

Sarah Holmes, New Hampshire-based state director to New Hampshire Sen. Jeanne Shaheen and a longtime aide to the senator, sold between $1,001 and $15,000 worth of stock in Delta Airlines on Jan. 24, as lawmakers were beginning to be clued into the forthcoming crisis.

Holmes traded out two stocks a week later, on Jan. 29, then on Feb. 27 made two purchases that could prove advantageous in the weeks ahead: Holmes purchased between $15,001 and $50,000 of stock in each of two more companies, the pharmaceutical company Gilead, Inc. – which makes remdesivir, a drug that is currently being tested to treat coronavirus – and wipe manufacturer Clorox.

The trades were made in a joint account, Shaheen spokesman Ryan Nickel said, and „were made at the complete discretion of her broker with no input from Sarah or her husband.“

Additionally, the sale of the Delta stock on Jan. 24 was made prior to the classified Jan. 24 briefing for senators, Nickel said, at 9:30 a.m., and „neither Senator Shaheen nor any of her staff were present for the classified briefing on Jan. 24.“ Holmes does not have a security clearance and has complied with disclosure requirements, Nickel added.

Though there is no current evidence that any of these elected officials or aides violated the law, there are several different bodies that could investigate lawmakers and aides for trading stocks. In addition to the ethics committees on Capitol Hill, the Department of Justice and the Securities and Exchange Commission have the authority to launch probes of their own.

Burr and other lawmakers’ trades may be enough to spur a probe from the federal government, said Kevin Muhlendorf, a former investigator at the Department of Justice and SEC.

“My gut on this is that based on the trading and the publicity, it’s highly likely that there will be some investigations by DOJ. I don’t think the political nature of this is going to stop that,” said Muhlendorf. “It’s going to come down to very fact-specific inquiries: What were the sources of information? What was the timing of the trades? Those are going to all have to be scrutinized closely and thoroughly.”

Source: politico.com

See more here: news365.stream